Gold, silver, and oil in 2025

The first half of 2025 offered many reasons for volatility, including trade wars, traditional wars, and new growth in cryptocurrencies.

In the second half of the year, the focus may shift smoothly from the search for stability to more promising undervalued instruments. We’ve analyzed the assets that may be at the center of market movements. Read on to learn when you should expect strategic opportunities with gold, silver, and oil.

Oil (XBRUSD)

The pause in the Middle East conflicts has reduced risks. But will it last? The war in Iran has demonstrated that oil instantly becomes the center of attention during escalations. A rise of 15%+ in a few days is a very vivid example.

Any new events, especially in the Strait of Hormuz, could push prices above $100, exacerbate inflation, and trigger revaluation in the energy sector. It will affect the shares of the largest oil companies and stimulate demand for hedging assets, including gold.

Silver (XAGUSD)

While other assets remain in focus, silver is quietly but steadily gaining momentum. Trading volumes are growing, and smart money is flowing into the metal. Silver remains undervalued compared to gold, which means it has huge potential.

If we face financial turbulence or inflationary pressure, demand for silver could skyrocket, causing a sharp price rise. Currently, the asset is moving upward globally. With further volume growth and a breakout from the channel, the price could reach 42.45.

Gold (XAUUSD)

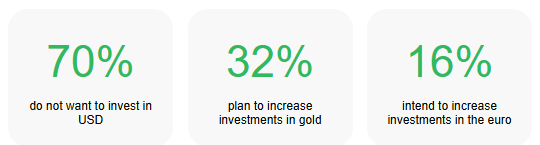

Gold remains a key benchmark for investors and traders in times of instability. Interest in gold remains consistently high as it is used to hedge against geopolitical risks, a weakening US dollar, and inflationary pressure.

Central banks and their plans in 2025

Major global banks predict the gold price could reach $4,000 per ounce in the medium term. Central banks continue to build up their gold reserves, and institutional funds show record-high inflows.

If we witness new geopolitical or economic instability in the Middle East, Asia, or Europe, gold will be the first line of defense for capital. It may grow less rapidly than oil or silver, but it is stable and reliable.

Remember, volatility always poses risks, but it also opens opportunities. You may want to consider the assets that can yield the highest returns when the market begins to move. And massive movements are very much possible in the coming months.

•Most Trusted Broker — Asia 2025

•Broker of the Year — LATAM 2025

These awards confirm our commitment to building a rewarding trading environment and helping you uncover your potential. Thank you for choosing to trade with an award-winning broker!

Why choose MetaTrader 5 with Top Forex Brokers?

•Blazing-fast execution & enhanced stability

•38 built-in technical indicators & 21 timeframes for precision trading

•Optimized for all devices—desktop, mobile & web

•Trade a wide range of assets: Stocks, Commodities, Forex & more!