In today’s fast-paced financial world, having access to a wide range of assets under one roof can make all the difference between a scattered portfolio and a streamlined strategy. I’ve always believed that true investment success comes from diversification—not putting all your eggs in one basket, as the old saying goes. That’s where XM shines as a broker. With over 15 years in the game and serving millions of clients worldwide, XM has built a reputation for making multi-asset trading accessible, efficient, and surprisingly user-friendly. We’ll explore what XM’s multi-asset offerings entail, from the instruments you can trade to the platforms that power it all. Whether you’re a seasoned trader or just dipping your toes in, there’s something here to consider.

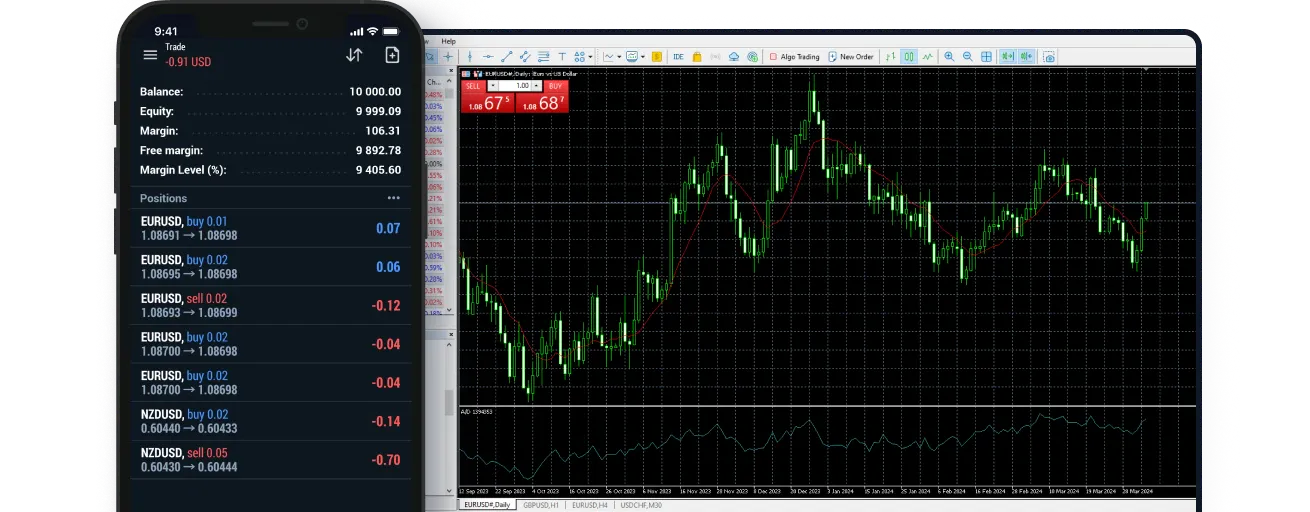

A glimpse of XM’s MT5 platform in action, showcasing real-time trading capabilities.

What Makes Multi-Asset Trading with XM Stand Out?

Multi-asset trading essentially means you can dabble in various markets—forex, stocks, commodities, and more—without needing multiple brokers or accounts. XM takes this a step further by offering over 1,000 instruments across eight asset classes. From my perspective, this setup is a game-changer for risk management. When forex pairs are volatile due to geopolitical events, you can pivot to commodities like gold or oil, which often act as safe havens. It’s not just about variety; it’s about building resilience into your trading approach.

XM operates under strict regulations from bodies like CySEC, ASIC, and the FSC, ensuring your funds are secure with segregated accounts and negative balance protection. They’ve also got a track record of ultra-fast execution speeds, which I’ve found crucial in avoiding slippage during high-market moments.

The Assets You Can Trade: A Breakdown

XM’s lineup covers everything from traditional forex to emerging crypto CFDs, though availability can vary by region. Here’s a quick table summarizing the key asset classes, with examples and some standout features based on their offerings:

| Asset Class | Examples | Key Features |

|---|---|---|

| Forex | EUR/USD, GBP/JPY, USD/CAD | Over 55 pairs, spreads from 0.6 pips, 24/5 trading |

| Stock CFDs | Apple, Tesla, Amazon | Access to global exchanges, no ownership but profit from price movements |

| Indices | S&P 500, FTSE 100, Nikkei 225 | Leverage up to 500:1, track major market trends without buying individual stocks |

| Commodities | Gold, Silver, Crude Oil | Hedge against inflation, spreads as low as 0.03 pips on gold |

| Energies | Brent Oil, Natural Gas | Capitalize on energy market volatility, flexible contract sizes |

| Metals | Platinum, Copper | Diversify with industrial metals, low margin requirements |

| Cryptocurrencies | Bitcoin, Ethereum, Ripple | 24/7 trading on CFDs, leverage up to 250:1 (where available) |

| Shares | Direct shares in select markets | For long-term investors, dividends and voting rights in some cases |

This diversity allows for creative strategies, like pairing forex trades with commodity hedges. In my experience, traders who stick to one asset class often miss out on opportunities—XM’s broad selection encourages a more holistic view.

Key Benefits of XM Multi-Asset Trading

XM stands out for its commitment to transparency, accessibility, and innovation. Here are some of the platform’s core advantages:

| Feature | Description |

|---|---|

| Diverse Asset Classes | Trade forex, stocks, commodities, indices, and cryptocurrencies on one platform. |

| Low Costs | Competitive spreads and low or no commissions, maximizing profitability. |

| Advanced Platforms | Access to MetaTrader 4 and 5 with customizable tools and automated trading. |

| Educational Resources | Free webinars, tutorials, and market analysis to support traders at all levels. |

| 24/5 Support | Multilingual customer service available around the clock for seamless trading. |

| Regulated and Secure | Licensed by top-tier regulators, ensuring safety and trust for your investments. |

These features create an environment where traders can thrive, regardless of market conditions. The ability to switch between assets without needing multiple accounts streamlines the process, saving time and reducing complexity.

Platforms and Tools: From MT4 to the New Unified Experience

XM supports the classics like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are favorites for their customizable charts, EAs (expert advisors), and one-click trading. MT5, in particular, is tailored for multi-asset enthusiasts, supporting stocks, futures, and more advanced order types.

But the real excitement came in September 2025 with the launch of their unified trading platform. This integrates TradingView’s top-tier charting tools, giving you professional-grade analysis right in the app. No more switching between platforms—everything’s seamless across desktop, mobile, and web. They’ve also rolled out XM AI, a smart assistant that provides market insights, trade suggestions, and even personalized risk assessments. I think this AI feature is underrated; it democratizes advanced analytics that were once reserved for institutional traders. Imagine getting real-time sentiment analysis on a stock while checking forex trends—all in one dashboard.

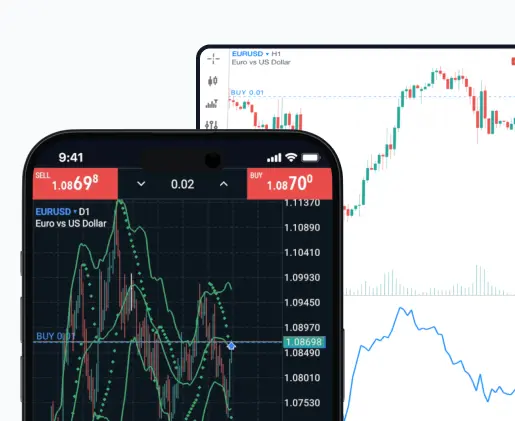

The XM mobile app complements this, with instant withdrawals, copy trading options, and educational resources. If you’re on the go, it’s a solid choice for monitoring positions without being glued to a screen.

XM’s MT5 on mobile devices, perfect for trading anytime, anywhere.

Account Types, Leverage, and Costs: Tailored for Every Trader

XM keeps things flexible with several account types to suit different styles. The Micro and Standard accounts are great for beginners, with micro-lots available for low-risk testing. The Ultra Low account, starting at just $5 deposit, offers razor-thin spreads (from 0.6 pips) and reduced commissions—ideal for high-volume traders. There’s also a Shares account for those interested in actual stock ownership.

Leverage is a highlight, going up to 1000:1 on forex, though it drops for other assets to manage risk. Spreads are competitive across the board, and most accounts are commission-free, except for the Zero account which has even tighter spreads but a small fee. No hidden charges here, which is refreshing in an industry full of surprises.

From my viewpoint, the low entry barrier is what sets XM apart. You don’t need a fortune to start, and their bonuses—like deposit matches—can give newcomers a boost without overcomplicating things.

Recent Innovations and Why They Matter

Just last month, XM doubled down on innovation with updates to their unified platform, emphasizing AI-driven tools for better decision-making. This isn’t just hype; in a market where data overload is common, having an AI sift through noise can save hours. Plus, their commitment to education—webinars, seminars, and a research portal—helps bridge the gap for less experienced users.

That said, while the tech is impressive, remember that no tool replaces sound judgment. I’ve seen traders rely too heavily on AI and overlook fundamentals, so use it as a supplement, not a crutch.

Is XM Right for Your Multi-Asset Journey?

XM’s multi-asset trading ecosystem offers a compelling mix of variety, technology, and reliability. If you’re looking to diversify without the hassle, it’s worth exploring. Personally, I appreciate how they’ve evolved from a forex-focused broker to a full-spectrum platform, especially with the recent AI integrations that feel forward-thinking yet practical. Of course, trading involves risks, so always do your due diligence and consider your financial situation.

Ready to give it a try? Head over to XM’s site to open a demo account and test the waters. Who knows—it might just become your go-to for navigating global markets.

•Most Trusted Broker — Asia 2025

•Broker of the Year — LATAM 2025

These awards confirm our commitment to building a rewarding trading environment and helping you uncover your potential. Thank you for choosing to trade with an award-winning broker!

Why choose MetaTrader 5 with Top Forex Brokers?

•Blazing-fast execution & enhanced stability

•38 built-in technical indicators & 21 timeframes for precision trading

•Optimized for all devices—desktop, mobile & web

•Trade a wide range of assets: Stocks, Commodities, Forex & more!

Disclaimer: Trading forex and CFDs carries a high level of risk and may not be suitable for all investors. Ensure you understand the risks involved and consider your financial situation before trading.