Choosing the Best Forex Trading Platform

In the fast-paced world of Forex trading, selecting the right platform can be a game-changer. A Forex trading platform is the software that bridges traders to the global currency market, enabling them to execute trades, analyze charts, and manage their accounts efficiently. With a plethora of options available, finding the best Forex trading platform can feel daunting. This guide breaks down the essentials, from key features to popular platforms, helping you make an informed choice.

What is a Forex Trading Platform?

A Forex trading platform is a software tool designed for online trading in the foreign exchange market. It provides real-time market data, advanced charting tools, and seamless order placement capabilities. These platforms come in various forms:

- Web-based platforms: Accessible from any device with an internet connection, offering flexibility.

- Desktop platforms: Packed with advanced features and customization for in-depth analysis.

- Mobile apps: Perfect for traders on the move, ensuring constant market access.

Whether you’re a beginner or a seasoned trader, understanding the role of a Forex trading platform is the first step to mastering the market.

Key Features to Look for in a Forex Trading Platform

Choosing the right platform means focusing on features that align with your trading goals. Here are the must-haves:

- User Interface: A clean, intuitive design enhances efficiency. Look for customizable layouts that suit your workflow.

- Charting Tools: Robust technical analysis requires diverse indicators, drawing tools, and multiple timeframes.

- Order Types: Flexibility in risk management comes from support for market, limit, stop, and trailing stop orders.

- Execution Speed: In Forex, every second counts. Fast, reliable execution ensures you capture the best prices.

- Security: Protect your funds with platforms offering encryption and two-factor authentication (2FA).

- Customer Support: 24/7 assistance via phone, email, or live chat can resolve issues quickly.

A platform excelling in these areas can elevate your trading experience and performance.

Popular Forex Trading Platforms

Let’s explore some of the best Forex trading platforms dominating the market today:

- MetaTrader 4 (MT4)

- Pros: User-friendly, extensive charting, supports automated trading via Expert Advisors (EAs).

- Cons: Lacks some advanced features of newer platforms.

- Best for: Beginners and traders who value simplicity.

- Learn more at MetaTrader 4.

- MetaTrader 5 (MT5)

- Pros: More timeframes, economic calendar, multi-asset trading capabilities.

- Cons: Slightly steeper learning curve than MT4.

- Best for: Traders needing a versatile, powerful toolset.

- Explore it at MetaTrader 5.

- cTrader

- Pros: Superior charting, lightning-fast execution, cAlgo for custom strategies.

- Cons: Smaller user community compared to MetaTrader.

- Best for: Technical traders and algo enthusiasts.

- Check it out at cTrader.

- TradingView

- Pros: Exceptional charting, social features for sharing trade ideas, broker integration.

- Cons: Not a standalone trading platform; requires a broker connection.

- Best for: Charting enthusiasts and community-driven traders.

- Visit TradingView.

Each platform offers unique strengths, making them suited to different trading styles and preferences.

How to Choose the Right Forex Trading Platform

The best platform varies by individual needs. Consider these factors:

- Trading Style:

- Day traders need speed and advanced tools.

- Long-term traders may prioritize research and multi-asset support.

- Experience Level:

- Newbies benefit from simple interfaces and educational resources.

- Pros might seek algorithmic trading and customization.

- Preferred Markets:

- Forex-only traders can opt for specialized platforms.

- Diversified traders should choose platforms supporting stocks, commodities, or crypto.

Test a platform’s demo account to see if it fits your strategy before committing.

Real-World Example: Why Platform Choice Matters

Imagine a day trader using MT4. They rely on its fast execution to scalp small price movements, leveraging EAs to automate trades. Meanwhile, a swing trader on cTrader uses its advanced charting to spot trends over days, customizing indicators via cAlgo. The right platform amplifies their strengths, proving that fit matters more than popularity.

Finding the best Forex trading platform is about aligning features with your goals. Whether it’s the simplicity of MetaTrader 4, the power of MetaTrader 5, the precision of cTrader, or the charting prowess of TradingView, your choice should empower your trading journey. Dive into the options, explore their strengths, and pick a platform that feels like an extension of your strategy.

•Most Trusted Broker — Asia 2025

•Broker of the Year — LATAM 2025

These awards confirm our commitment to building a rewarding trading environment and helping you uncover your potential. Thank you for choosing to trade with an award-winning broker!

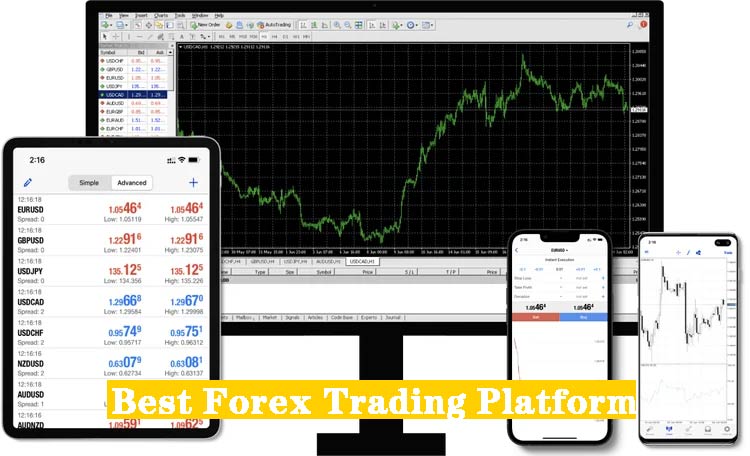

Why choose MetaTrader 5 with Top Forex Brokers?

•Blazing-fast execution & enhanced stability

•38 built-in technical indicators & 21 timeframes for precision trading

•Optimized for all devices—desktop, mobile & web

•Trade a wide range of assets: Stocks, Commodities, Forex & more!